Stock Market APIs provide a gateway to a wealth of market data and insights for financial analysts and traders alike. They connect users to historical and real-time financial information, which has become integral to making informed investment decisions.

However, choosing the right stock market API is not exactly a straightforward process. You need to carefully consider several aspects to make sure that the API you choose meets your specific needs. Of course, factors such as reliability, ease of use, developer support, and data comprehensiveness also play a vital role in this process. And so does competitive pricing and specific features such as access to historical data can also influence your choice.

In this post, we’ll outline the best stock market APIs available in 2024, with a special focus on these criteria. We’ll explore the top API providers that offer reliable and comprehensive data on stock prices, historical trends, trading volumes, financial statements, and so much more.

Understanding Stock Market APIs

Stock market application programming interfaces (APIs) provide you access to historical and real-time stock market data. These APIs allow traders, developers, analysts, and other financial professionals to access a wide variety of information about stocks, including prices, historical data, trading volumes, company news, financials, and more.

With this information, users can integrate stock market data into their websites, trading platforms, and analytical tools, which should enable them to develop better trading strategies, analyze market trends, conduct thorough research, and ultimately make informed decisions.

API data is presented in a standardized format, such as CSV or JSON, which makes it easy for developers to take up and process the data within their applications. They will often provide a wide range of methods and endpoints that allow users to retrieve specific types of stock market data depending on their requirements.

1. Alpha Vantage

Alpha Vantage is a popular choice among developers and traders for its comprehensive suite of financial data APIs. It provides comprehensive real-time and historical stock market data, along with a suite of financial data APIs that cater to a variety of asset classes, including ETFs, stocks, forex, mutual funds, cryptocurrencies, and commodities.

Here’s why it stands out:

Extensive Coverage: Alpha Vantage offers a wide range of data endpoints, including real-time and historical stock prices, technical indicators, fundamentals, and cryptocurrency data.

Multiple data types: Offers historical and real-time data with more than 60 technical and economic indicators, with market news APIs and sentiments.

Ease of Use: The API is user-friendly, with straightforward documentation and SDKs available for popular programming languages such as Python, Java, and JavaScript.

Free Tier: Alpha Vantage provides a generous free tier with access to most data endpoints, making it accessible to developers and small-scale traders.

Customizable: Users can customize their data requests and specify parameters such as time intervals, output formats, and data transformations to suit their needs.

The comprehensive data offerings along with its flexible pricing options and excellent customer support make it a great overall tool for traders, financial analysts, and developers looking for a dependable source of financial data.

2. IEX Cloud

IEX Cloud, operated by the Investors Exchange (IEX), offers a reliable and feature-rich API for accessing market data. The platform offers real-time updates for fundamental data, stock prices, and technical indicators. The update frequency largely depends on the type of data. For instance, technical indicators are updated every 5 minutes while stock prices are updated every 15 seconds.

Here are some key highlights:

High-Quality Data: IEX Cloud provides high-quality, institutional-grade market data sourced directly from the Investors Exchange, ensuring accuracy and reliability.

Real-time updates: IEX Cloud provides real-time updates for technical indicators, fundamental data, and stock prices. The frequency of these updates will largely depend on the type of data.

Flexible Pricing: The API offers flexible pricing plans tailored to the needs of individual users, with options for free access with limited features and paid subscriptions with advanced data sets and premium support.

Historical data: IEX Cloud provides historical data for stock prices going way back to 2008. Depending on the data type, the historical data is also granular. For instance, stock prices are available in monthly, weekly, and daily intervals.

Advanced Features: In addition to basic stock market data, IEX Cloud offers advanced features such as alternative data sets, international market data, and corporate action data, catering to the needs of sophisticated investors and developers.

Comprehensive Documentation: The API documentation is comprehensive and well-maintained, with code examples, API references, and tutorials to help users get started quickly. Support is also available via email and a forum.

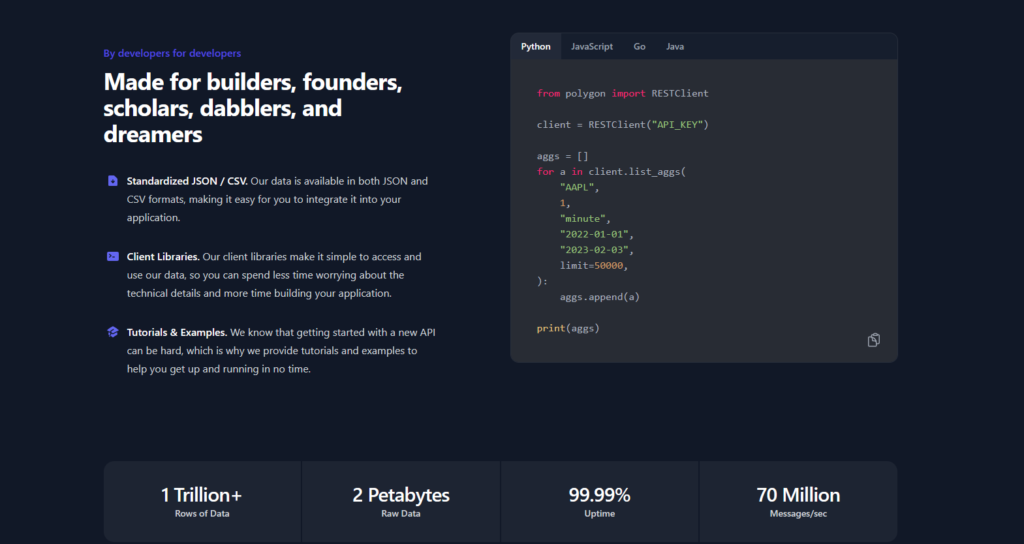

3. Polygon

Polygon.io specializes in providing real-time and historical market data through its powerful API platform. Polygon API offers streamlined access to real-time news, historical data, prices, company information, and more. This is quite convenient when looking to strategize backtests, train models, develop applications, and meet certain professional standards.

Here’s what makes it a standout choice:

Real-Time Data: Polygon.io offers real-time streaming data for stocks, indices, cryptocurrencies, and forex markets, enabling traders to react quickly to market movements.

Normalized Market Data: This is a feature that essentially provides both historical and real-time market data, with detailed trade and quote messages from all US exchanges and dark pools.

Market Coverage: The API provides coverage of major exchanges, including NYSE, NASDAQ, and global exchanges, with support for equities, ETFs, options, and futures.

Scalability and Reliability: Polygon.io’s infrastructure is designed for scalability and reliability, ensuring minimal downtime and high-performance data delivery, even during periods of high market activity.

Developer-Friendly: The API is developer-friendly, with a RESTful architecture, WebSocket support, and SDKs available for popular programming languages such as Python, JavaScript, and Ruby.

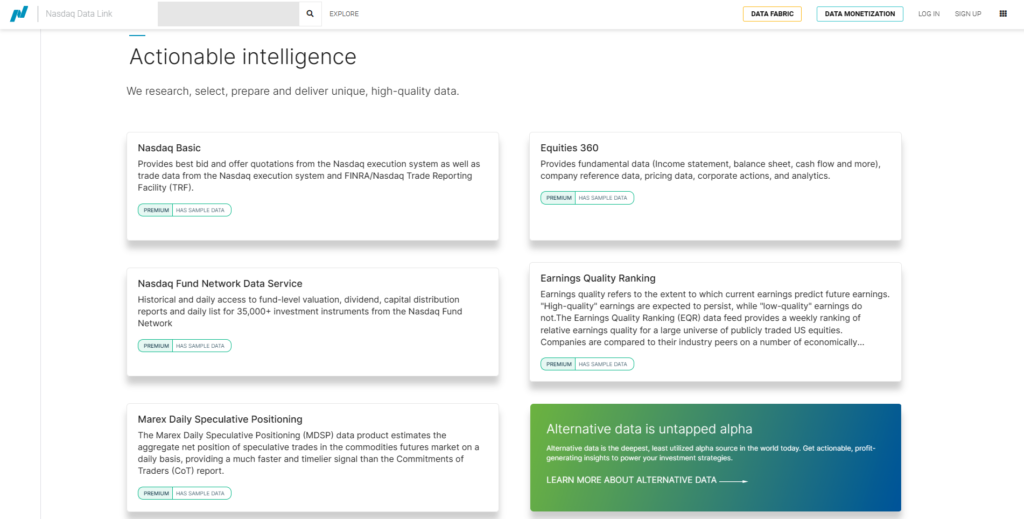

4. Quandl

Quandl is a leading provider of financial and alternative data, offering an extensive library of datasets through its API platform. Its API provides extensive coverage of financial data, including stock prices, options, futures, indices, bonds, commodities, and more. There are also alternative data sets, including sentiment analysis, economic indicators, and social media data.

Here are some notable features:

Diverse Data Sets: Quandl offers access to a diverse range of financial data, including stock prices, economic indicators, commodities, interest rates, and more, sourced from various providers and exchanges.

Data Quality: Quandl emphasizes data quality and accuracy, with rigorous validation processes and data cleansing techniques to ensure reliable and consistent data delivery.

Customizable Data Bundles: Users can create customized data bundles by selecting specific data sets and time periods, allowing for tailored analysis and research.

Integration with Python: Quandl provides a Python library that simplifies data retrieval and analysis, making it easy for Python developers to incorporate Quandl data into their applications and trading strategies.

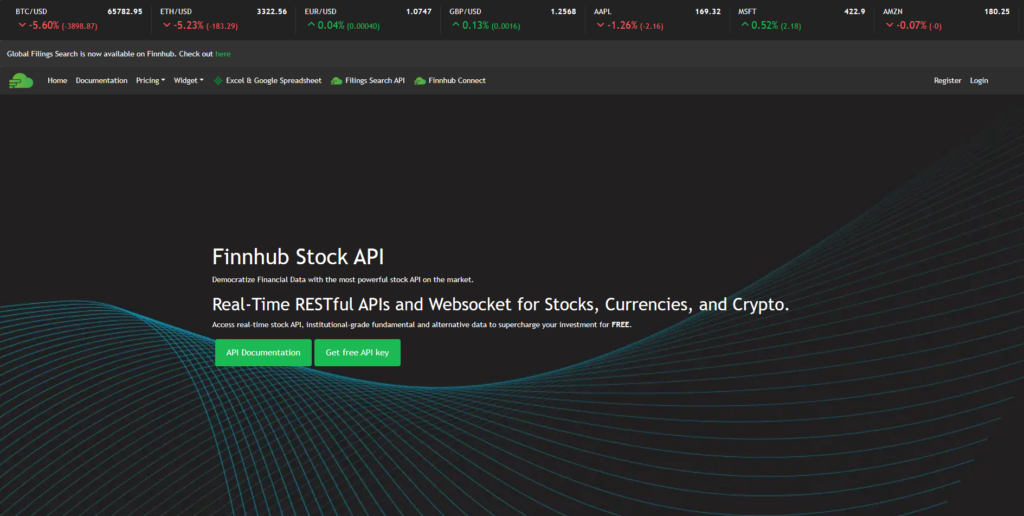

5. Finnhub API

Finnhub is an API mainly targeted towards investors, investment firms, and fintech startups. It provides institutional-grade financial data, including global fundamentals, real-time stock prices, and ETF holdings. One of the main draws to Finnhub is its extensive features and user-friendly interface, which has gained lots of positive customer feedback for its usability.

Notable features:

Real-time updates: Finnhub gives you a real-time update on stock prices, letting you access updated market data. This is vital for applications that need real-time data and information for quick decision-making.

News and Sentiment Analysis: In addition to market data, Finnhub offers news sentiment analysis APIs that analyze news articles and social media sentiment to provide insights into market sentiment and trends.

Fundamental Data: Finnhub’s fundamental data APIs provide access to company financials, earnings, dividends, corporate actions, and other fundamental data points, enabling users to perform in-depth fundamental analysis.

Crypto Data: For those interested in cryptocurrencies, Finnhub offers cryptocurrency market data APIs that provide real-time prices, trading volumes, historical data, and other relevant metrics for popular cryptocurrencies.

Developer-Friendly: Finnhub’s APIs are easy to integrate into applications and trading systems, with comprehensive documentation, code examples, and SDKs available for popular programming languages such as Python, JavaScript, and Java.

FAQ Section: Stock Market APIs

Q: What is a Stock Market API, and why is it useful?

A: A Stock Market API (Application Programming Interface) is a set of protocols, tools, and endpoints that allow developers to access and retrieve real-time and historical financial data from stock exchanges and other market sources. These APIs are useful for traders, analysts, and developers as they provide a convenient and efficient way to access market data for research, analysis, and automation of trading strategies.

Q: Are Stock Market APIs free to use?

A: While some Stock Market APIs offer free access with limited features or usage quotas, many providers offer paid subscription plans with access to premium features, higher data limits, and dedicated support. The availability of free or paid access depends on the provider and the specific features and data sets the user needs.

Q: What types of data can I access using Stock Market APIs?

A: Stock Market APIs typically provide access to a wide range of financial data, including real-time and historical stock prices, market indices, company fundamentals, technical indicators, corporate actions, and alternative data sets such as sentiment analysis and social media trends. Some APIs also offer access to data from other asset classes, including cryptocurrencies, commodities, and forex markets.

Q: How reliable and accurate is the data provided by Stock Market APIs?

A: The reliability and accuracy of data provided by Stock Market APIs vary depending on the provider and the data sources used. Most reputable providers prioritize data quality and accuracy, employing rigorous validation processes, data cleansing techniques, and direct sourcing from reliable exchanges and data providers to ensure the integrity of the data delivered through their APIs. Users should review the provider’s documentation, reputation, and customer reviews to assess the reliability of the data.

Q: Can I use Stock Market APIs for algorithmic trading and automation?

A: Yes, Stock Market APIs are commonly used for algorithmic trading and automation of trading strategies. These APIs allow developers to programmatically access market data, execute trades, manage portfolios, and implement complex trading algorithms and strategies. However, users should be aware of the risks associated with algorithmic trading, including market volatility, execution risks, and regulatory considerations, and should exercise caution and proper risk management techniques when deploying automated trading systems.

Q: Are there any regulatory or compliance considerations when using Stock Market APIs?

A: Depending on your jurisdiction and the nature of your activities, there may be regulatory and compliance considerations when using Stock Market APIs, especially for algorithmic trading and automated trading systems. Users should familiarize themselves with applicable securities regulations, licensing requirements, data usage agreements, and privacy laws to ensure compliance with relevant regulations and avoid potential legal issues. Additionally, users should respect the terms of service and usage policies set forth by the API providers to maintain a positive relationship and avoid violations or account suspension.

Q: Can I access historical market data using Stock Market APIs?

A: Yes, many Stock Market APIs offer access to historical market data, allowing users to retrieve historical stock prices, trading volumes, and other relevant data points for analysis, backtesting, and research purposes. Users can specify the time range, intervals, and data granularity (e.g., daily, hourly, minute-by-minute) when making data requests to retrieve historical data for specific periods.