Investing has evolved dramatically over the past decade, offering more options than ever before. Beyond traditional stocks and bonds, alternative investments have become increasingly popular. These investments include real estate, commodities, private equity, and more.

In 2024, several apps and platforms stand out as the best options for those looking to diversify their portfolios with alternative investments. Here’s our compilation of the top ten apps and platforms for alternative investments.

1. Fundrise

Fundrise is one of the most popular alternative investment apps for real estate, offering various investment options including REITs, specialized funds, and individual deals.

Primarily known as a real estate crowdfunding platform, Fundrise recently introduced the Fundrise Innovation Fund. This alternative investment fund acquires stakes in private, high-growth technology companies.

Fundrise launched this fund to provide broader access to private company investments, which have historically been inaccessible to most investors despite being one of the best-performing investment strategies over the past 50 years.

The fund includes positions in companies like Databricks, Roblox, Block, Canva, and more. While direct investment in these private companies may not be possible, you can invest in Fundrise’s venture fund. The primary benefit of Fundrise is its ability to offer access to private companies via a venture capital fund that is accessible to retail investors.

Features:

Ease of Use: The intuitive platform is suitable for both beginners and experienced investors.

Diverse Portfolio: Offers a mix of residential and commercial properties.

Low Minimum Investment: Start investing with as little as $500.

Pros:

- User-friendly platform ideal for beginners and experienced investors.

- Diverse Portfolio: Offers a mix of residential and commercial properties.

- Low Minimum Investment: Start investing with as little as $500.

- Passive Income: Potential for regular dividend payments.

Cons:

- Investments are not easily liquidated and typically require a long-term commitment.

- Management and advisory fees can impact overall returns.

- Real estate market fluctuations can affect investment value.

Why We Like It: Fundrise provides a straightforward way to invest in real estate, with a low entry barrier and a user-friendly interface.

2. Yieldstreet

Yieldstreet is an alternative investment platform offering a vast selection of assets through a user-friendly dashboard and competitive fees.

Founded in 2015, Yieldstreet has rapidly become a leading platform for investing in a variety of non-traditional assets. Available investment opportunities include crowdfunded real estate, rare artwork, cryptocurrency, private deals, venture capital, and more.

While most offerings require you to be an accredited investor, the Yieldstreet Prism Fund is accessible to non-accredited investors. Yieldstreet’s portfolios allow you to invest in multiple asset classes within a single investment, providing instant diversification. Fees range from 0% to 2.5% annually, depending on the investment.

Features:

Variety of Asset Classes: Includes real estate, marine finance, legal finance, and art.

Transparency: Detailed information about each investment.

Auto-Invest: Automatically invests in new opportunities based on your preferences.

Pros:

- Access to real estate, marine finance, legal finance, and art.

- Detailed information about each investment.

- Automatic reinvestment options.

- Potential for higher returns compared to traditional investments.

Cons:

- Some offerings require significant capital to start.

- Non-traditional investments carry higher risk.

- Limited options for early withdrawal of funds.

Why It’s Great: Yieldstreet’s diverse range of asset classes and transparent investment options make it a solid choice for alternative investments.

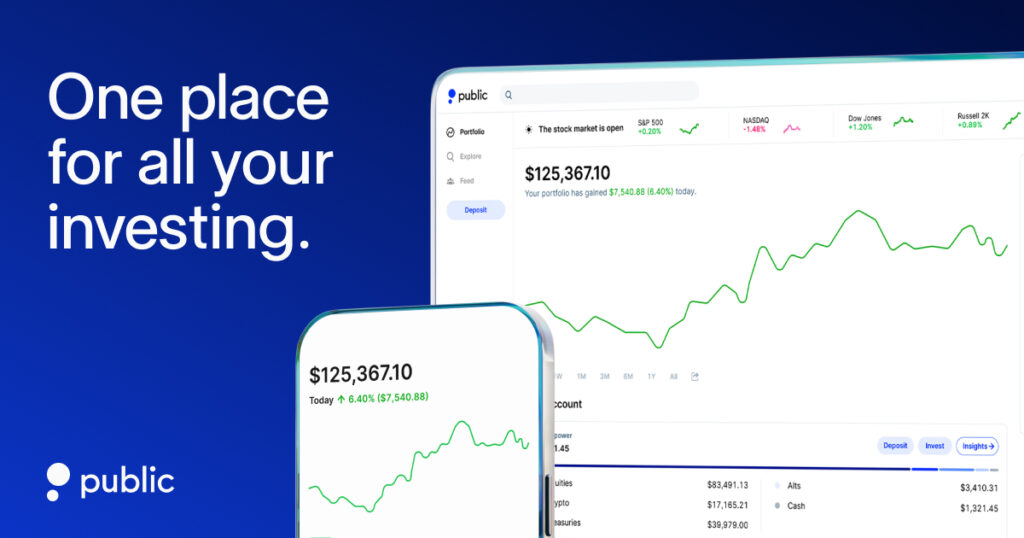

3. Public

Public is a trading platform and one of the best alternative investment apps available. Why? It offers commission-free trading on stocks and ETFs and includes a wide range of assets like NFTs, rare sports cards, collectible sneakers, famous artworks, and more.

A unique feature of Public is its secondary trading market, where you can buy and sell shares of ownership in these alternative assets. Additionally, there are no accreditation requirements, making it accessible for anyone to invest in collectibles, stocks, and other assets.

However, it’s important to note that investing in alternative assets comes with a 2.5% commission per transaction. If you plan to actively trade alternative assets, these fees can add up.

Features:

Ease of Use: The platform is designed to help you learn about investing and invest slowly

Accessible: No accreditation requirements, and offers free stock and ETF trading.

Versatile: It lets you add alternative assets to your traditional portfolio.

Pros:

- Public offers commission-free trading on stocks and ETFs, making it cost-effective for traditional investments.

- Access to a wide range of alternative assets, including NFTs, rare sports cards, collectible sneakers, and famous artworks.

- Allows users to buy and sell shares of ownership in alternative assets, providing liquidity and flexibility.

- Open to all investors, not just accredited ones, making alternative investments accessible to a broader audience.

- The platform is designed to be intuitive and easy to navigate, suitable for both beginners and experienced investors.

Cons:

- Transaction Fees: A 2.5% commission per transaction on alternative assets can become expensive for active traders.

- Lacks some advanced trading tools and features that more experienced investors might look for.

- Alternative assets can be more volatile and carry higher risks compared to traditional investments.

- While the secondary trading market provides some liquidity, it may not be as deep as traditional stock markets, potentially making it harder to sell assets quickly.

Why We Like It: Public is an excellent platform for those looking to diversify their portfolios with alternative investments alongside traditional stocks and ETFs.

4. Masterworks

Art and antiquities are among the most high-profile segments of alternative investing, though their financial footprint is relatively small compared to other investment products. Despite the limited volume of money and transactions, the art world captivates the popular imagination, as the value of discovering a Picasso or Monet is widely recognized.

The challenge with art investment, much like real estate, is the substantial buy-in required. Typically, you can’t invest in a Van Gogh unless you can afford to purchase the entire painting. Masterworks.io addresses this issue by allowing you to buy shares in art and antiquities for as little as $20. These shares function like any other securitized investment: you purchase a percentage of the artwork, and when it sells at auction, you receive returns based on your share.

This platform enables you to participate in the art market with a relatively small investment. Moreover, Masterworks.io is accessible to non-accredited investors. However, retail investors should be aware of the fees: annual management fees are 1.5%, and Masterworks.io takes 20% of the profit from an artwork’s sale.

Features:

Blue-Chip Art: Invest in works by artists like Picasso and Warhol.

Expert Curation: A team of art experts selects investment-grade pieces.

Secondary Market: Sell your shares to other investors if you need liquidity.

Pros:

- Invest in high-value works by renowned artists.

- Art is selected by a team of experts.

- Option to sell shares to other investors for liquidity.

Cons:

- Transaction and management fees can be high for individual investors.

- Art investments are generally long-term and not easily sold.

- The art market can be unpredictable.

Why We Like It: Masterworks provides access to the art market, which has traditionally been difficult for individual investors to enter.

5. Groundfloor

Groundfloor is an alternative real estate investing platform that provides opportunities to invest in high-yield, short-term property loans. Unlike many other platforms, Groundfloor is open to non-accredited investors and private individuals seeking active real estate investments. With an average of 50-70 investments available at any given time, it offers substantial volume.

One of the key advantages of Groundfloor is its accessibility for individuals with small portfolios, thanks to a low $10 minimum investment and zero investor fees. This low entry point makes it easy for investors to diversify their portfolios across multiple loan offerings.

Features:

Low Minimum Investment: Start with just $10.

Short-Term Investments: Loans typically last 6-12 months.

Transparency: Detailed information about each loan.

Pros:

- Low minimum investment requirement – you can start investing with just $10.

- Suitable for short-term investments – loans typically last 6-12 months.

- Detailed information about each loan is provided.

Cons:

- High-yield loans come with higher risk.

- Investments are tied up until loans are repaid.

- Focuses primarily on real estate loans.

Why We Like It: Groundfloor’s low minimum investment and short-term commitments make it accessible and appealing to a wide range of investors.

6. EquityMultiple

EquityMultiple is a crowdfunding platform specializing in commercial real estate, gaining popularity due to its compelling investment offerings. One notable option is the Ascent Income Fund, which targets annualized returns of 11-13% from senior debt positions, ensuring each investment is backed by commercial real estate assets.

With a $20,000 minimum investment, Ascent is ideal for yield-focused investors. EquityMultiple’s most popular investment product is the Alpine Note, which offers term lengths of 3, 6, and 9 months with fixed annual percentage yields (APYs) of 6.00%, 7.05%, and 7.4%, respectively.

Primary Benefit: Invest in commercial real estate through short-term debt, equity, and funds.

Features:

Diverse Opportunities: Invest in equity, preferred equity, and senior debt.

Experienced Team: Managed by real estate professionals.

Robust Reporting: Detailed performance reports.

Pros:

- Invest in diversified assets including equity, preferred equity, and senior debt.

- The funds are managed by real estate professionals.

- Detailed performance reports are available.

Cons:

- Requires a high minimum investment to get started.

- Management and performance fees can impact returns.

- Investments are generally long-term and not easily liquidated.

Why We Like It: EquityMultiple’s diverse investment opportunities and professional management make it a strong choice for real estate investors.

7. Arrived

Arrived is a real estate crowdfunding platform that caters to both accredited and non-accredited investors.

Focusing exclusively on single-family homes, Arrived acquires properties for both long-term and short-term (vacation) rentals. Investors benefit from both rental income and property appreciation.

Arrived handles every aspect of the process, from evaluating and purchasing properties to listing and managing them. This means you don’t have to worry about market research, legal contracts, closing costs, maintenance, repairs, or tenant issues.

After purchasing a property, Arrived securitizes it and offers shares for purchase on its platform. Investors can buy fractional shares of individual single-family homes starting at just $100. Shareholders then earn quarterly dividends from rental income, and these dividends range from 3.2% to 7.2% annually, though this does not account for property appreciation due to the company’s relatively recent establishment. Like Fundrise, Arrived charges a 1% annual management fee.

Pros:

- Open to both accredited and non-accredited investors.

- Low minimum investment of $100.

- Ability to invest in fractional shares of single-family homes with opportunities in both long-term and short-term rental properties.

- Arrived handles property evaluation, purchase, listing, and management and the investors benefit without dealing with market research, legal contracts, or maintenance.

- Quarterly dividends from rental income with potential for property appreciation over time.

Cons:

- 1% annual management fee, which can impact overall returns.

- Focuses solely on single-family homes, lacking other real estate types.

- Relatively new, so long-term performance data is limited.

8. AcreTrader

AcreTrader is an excellent platform for investing in farmland, offering ownership shares in farms across the U.S. with a relatively low minimum investment. As farmland becomes one of the fastest-growing assets in the country, AcreTrader makes it accessible by purchasing land and allowing investors to buy shares of partial ownership.

The platform allows you to browse specific deals and invest in those you prefer, providing comprehensive offering circulars and detailed information about the farms and crops on the land. Most investment opportunities require a minimum investment of around $10,000. While AcreTrader is a relatively new platform, it has shown promising returns, averaging around 11% APY.

Pros and Cons of AcreTrader

Pros:

- Average returns of around 11% APY, which are attractive compared to other investment options.

- Provides a way to invest in farmland, a traditionally hard-to-access asset class, with relatively low minimum investments.

- Offers comprehensive offering circulars and detailed information about each farm and its crops, helping investors make informed decisions.

- Allows investors to diversify their portfolios by including farmland, which can be a stable and appreciating asset.

- AcreTrader handles all aspects of land management, from acquisition to administration, freeing investors from the burdens of direct management.

Cons:

- Most deals require a minimum investment of around $10,000, which can be a barrier for some investors.

- AcreTrader is relatively new, so it has a shorter track record compared to more established investment platforms.

- Some deals may require investors to be accredited, limiting access to certain opportunities for non-accredited investors.

- Investments are concentrated in U.S. farmland, which might not offer enough geographic diversification for some investors.

9. Crowdstreet

CrowdStreet is one of the most established real estate crowdfunding platforms, operating since 2012. The company has funded over 798 deals (168 of which have been sold), investing more than $4.2 billion on behalf of its investors. From the 168 sold deals, CrowdStreet has achieved a 17.9% realized IRR with an average holding period of 3.1 years.

The platform connects investors with developers seeking to raise capital for their projects. CrowdStreet has invested in 17 different property types, including hotels, multifamily apartment complexes, storage facilities, and industrial parks.

Each proposed deal is vetted by a seasoned team of analysts with a combined $6.5 billion in transactional experience before being listed on CrowdStreet’s Marketplace, ensuring confidence in the deals presented. Investors can choose to invest in individual deals or opt for CrowdStreet’s Diversified Funds for easier diversification. Additionally, high-net-worth investors have the option of professionally managed portfolios.

Features:

Wide Range of Investments: From individual properties to diversified funds.

Detailed Information: Extensive data on each investment.

Educational Resources: Tools and resources to help investors make informed decisions.

Pros:

- Offers a wide range of investments including individual properties and diversified funds.

- Extensive data is available on each investment.

- Educational resources and tools to help investors make informed decisions.

Cons:

- The high minimum investment to get started.

- Commercial real estate investments carry market risks.

- Requires a long-term commitment with limited options for an early exit.

Why We Like It: CrowdStreet is one of the most established and likely the largest platforms for commercial real estate investing.

10. Prosper

Prosper was one of the pioneering platforms in peer-to-peer (P2P) lending, serving as a model for subsequent P2P platforms. This alternative investment platform connects borrowers with an investment pool of Prosper users. For loan amounts between $2,000 and $40,000, Prosper users can lend the total or partial amount based on criteria similar to those used by banks, such as credit score, income, and the expected return from interest.

With Prosper, you can invest in personal loans, effectively acting as a bank by lending money to borrowers in exchange for interest payments. The platform boasts an average historical return of 5.7% per year, and you can start investing with as little as $25.

Borrowers make monthly payments, allowing investors to earn interest quickly. Prosper employs measures to mitigate risk, including minimum credit score requirements and proof of income and bank statements. Investors can choose individual loans to fund or use Prosper’s “Auto Invest” feature, which funds loans matching preset criteria.

It’s important to note that the loans are unsecured, and borrowers can default. However, the low $25 minimum investment allows investors to spread their risk across multiple loans.

Pros:

- One of the first platforms in peer-to-peer lending, providing a trusted and established option.

- A low minimum investment of $25 allows investors to start with a small amount and spread risk across multiple loans.

- The average historical return is 5.7% per year, offering a competitive rate compared to traditional investments.

- Investors can choose individual loans to fund or utilize the “Auto Invest” feature to automate the process based on preset criteria.

- Borrowers make monthly payments, allowing investors to begin earning interest relatively quickly.

- Prosper has borrower requirements, such as minimum credit scores and income verification, to help reduce risk.

Cons:

- Loans are unsecured, meaning borrowers can default, leading to potential losses for investors.

- While investors can select loans, they may have limited control over individual loan performance and borrower behavior.

- The peer-to-peer lending market can be affected by economic changes, impacting borrower repayment rates.

- Prosper may charge fees, which can eat into investment returns, especially for smaller investors.

- Loans typically have longer terms, meaning capital may be tied up for an extended period, limiting liquidity.

Final Thoughts: The Best Apps and Platforms for Alternative Investments

When it comes to investing, diversification is essential for minimizing risk and maximizing returns. Alternative investments provide a valuable way to diversify your portfolio and potentially achieve higher returns.

Some of the top alternative investments include real estate, art, collectibles, private companies, venture capital, and private credit blended notes. However, it’s important to keep in mind that these investments also carry inherent risks, such as illiquidity and value fluctuations.

The apps and platforms listed above offer a range of investment opportunities, from real estate and art to private equity and venture capital. Whether you’re a seasoned investor or just getting started, these platforms provide the tools and resources you need to succeed in the world of alternative investments.