Technology has democratized access to financial markets. But to generate consistent profits, traders and investors are always on the lookout for tools and technologies that can give them an edge in today’s fast-paced financial markets.

With the advent of artificial intelligence and machine learning, new tools have emerged to power smarter trading decisions, make predictions, and automate trades. While some of these tools offer AI-powered predictions and insights, others provide automated trading services.

In this article, we explore the best AI trading tools available in 2024, highlighting their features, functionalities, and the impact they have on modern investment practices.

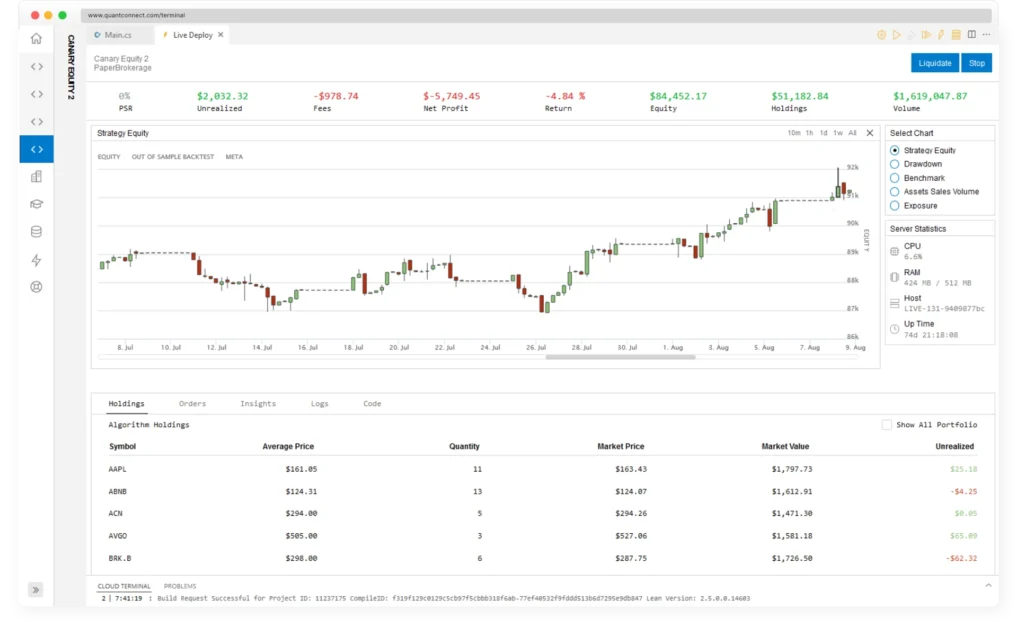

1. QuantConnect

Starts from $8 per user per month

QuantConnect is a leading AI-powered algorithmic trading platform that empowers investors to design, test, and deploy trading strategies seamlessly. The company offers free financial data and allows both paper trading and live trading. You can also backtest your strategies based on your data or that of popular brokerages, including Forex, Equities, Options, Futures, CFDs, and Crypto.

Key Features:

Advanced Backtesting: QuantConnect offers extensive historical data and robust backtesting capabilities, allowing users to evaluate strategies across various market conditions.

Customizable Algorithms: Investors can code and customize their trading algorithms using multiple programming languages, including C#, Python, and F#.

Cloud-Based Infrastructure: The platform operates on a scalable cloud infrastructure, enabling real-time data processing and high-speed execution.

Live Trading: QuantConnect supports live trading, where you can automate and execute trades in real-time with a range of supported brokers, including Interactive Brokers, FXCM, and Oanda.

Pros:

- Intuitive user interface

- Open-source algorithmic trading platform

- Supports a wide variety of financial assets

- Cloud-based tools with a comprehensive data library

- Flexible coding environment with extensive documentation

- In-built broker integration and live trading

Cons:

- Steep learning curve

- Requires solid experience in programming

2. Trade Ideas

Standard Plan: $84/month or $999/year.

Trade Ideas is an AI-powered stock scanning and trading platform designed to assist traders in generating actionable trade opportunities. The tool uses cutting-edge algorithms and machine learning to scan the market in real-time for trading patterns and opportunities.

Key Features:

AI-Powered Scanning: Trade Ideas utilizes machine learning algorithms to scan the market for potential trading opportunities based on user-defined criteria.

Real-Time Alerts: Users receive real-time alerts and notifications on potential trade setups, enabling prompt decision-making.

Backtesting and Performance Tracking: Traders can backtest strategies and track performance metrics to refine their trading approach over time.

Pros:

- Cutting-edge AI technology with extensive scanning capabilities

- User-friendly interface and actionable insights

- Active community

Cons:

- Significant learning curve for new users.

- Expensive.

3. Sentieo by AlphaSense

Starts at $480/month

Sentieo is an AI tool designed to help financial professionals analyze the stock market. It uses Artificial Intelligence to analyze company filings, event transcripts, trade journals, expert calls, equity research, news, and other privately or publicly available content to provide insights and practical records for actionable investment decisions.

Key Features:

AlphaSense lets you search through regulatory content, broker research, conference and earning call transcripts, SEC filings, news, and private company data, along with 4,000+ trade journals.

Wall Street Insights gives you access to a collection of aftermarket and real-time research from global brokers as well as regional firms.

Helps financial professionals filter searches to refine the outcome in such a way that it generates actionable investment ideas and mitigates risks.

Can also help you track market trends and monitor competition.

Pros:

- Great user interface

- Comprehensive data sources

- Fully featured search and custom filtering options for personalized market insights

- Summarizes earning calls

- All information can be displayed on a single window

Cons:

- Search may be clunky at times

- Expensive fees, especially for new traders

4. Dash2Trade

This is a powerful AI trading platform with a variety of features designed to help you find trading opportunities in the crypto market. One of the main draws to Dash2Trade is crypto trading bots. Dash2Trade also uses AI to deliver technical analysis-based signals for crypto trading.

There is also a social media chatter that provides bearish/bullish signals, which could help you discover small-cap cryptos that are about to explode.

Key Features:

AI-based trading bots that autonomously buy or sell crypto

Some of the strategies on offer include Grid Trading and Dollar Cost Averaging

No fees charged to use their bots

Pros:

- Analyzes social media to find trending cryptocurrencies

- Using bots is free of charge

- Leverages AI to deliver technical trading signals

- Can score cryptocurrency presales to identify potential winners

Cons:

- Only cryptocurrency trading is available

5. TrendSpider

TrendSpider essentially brings automated technical analysis with a unique machine-learning algorithm. The stock market analysis software is meant to work for both day traders and general investors. The algorithm essentially scans historical market data to find trends, which you can use to make profitable trades or investments.

TrendSpider also offers Trading Bots, which can turn your trading strategy into an automated and position-aware bot that you can use for virtually any task. The bots let you automatically trigger an event when certain parameters of your strategy are met. They are also highly flexible and customizable, and you can tune them to match your strategy.

Key Features of TrendSpider

Highly flexible and customizable trading bots

Dynamic alert system

Automatic technical analysis with price action alerts, Fibonacci retracement detections, price gap detection, moving averages, etc.

Pros:

- Automated charting tools and alerts

- 7-day free trial

- Straightforward and easy-to-use interface

- Good documentation and training features

Cons:

- Lacks direct integration with brokers

- The interface might not be friendly for beginners

- Relatively steep learning curve

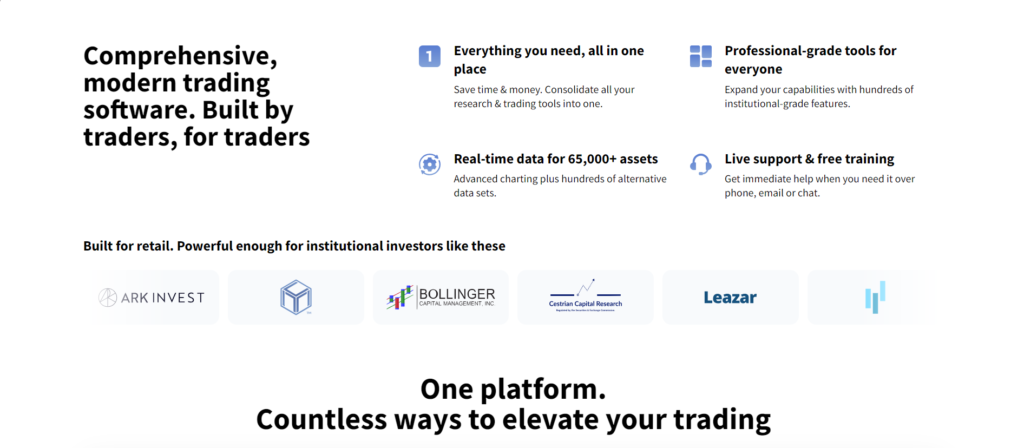

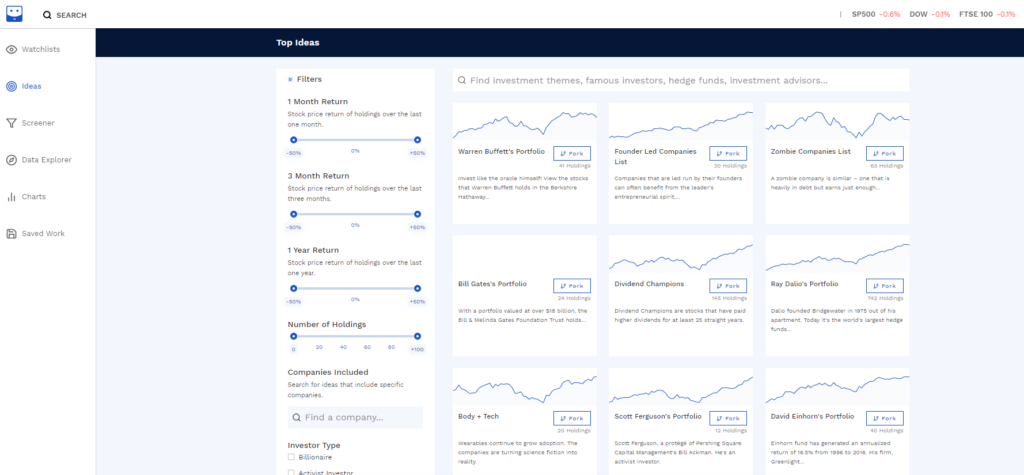

6. FinBox

Finbox is a stock market research and portfolio management platform designed for individual investors. It’s focused on fundamental and quantitative analysis, utilizing classic tools and intuitive designs. The platform is powered by advanced machine-learning algorithms that essentially do all the work of optimization and presentation. FinBox premium gives quants and developers access to APIs that they can use to integrate data into their models and algorithms.

Key Features:

In-depth fundamental analysis with enhanced stock analysis and actionable ideas.

The FinBox Ideas Section creates fresh trading ideas based on what other popular investors have in their portfolios.

Intrinsic value calculator that does all the heavy lifting for you, using detailed valuation models.

A stock screener that provides various valuation-based data, with the ability to see a stock’s future performance returns compared to what Wall Street Analysts are saying.

Pre-built financial models that you can refine, edit, and share.

Pros:

- Direct focus on fundamental stock analysis

- Automatic data aggregation from several sources

- The intrinsic value calculator and the FNBX function are a huge plus.

Cons:

- The sheer amount of data available can be overwhelming for beginners

- Rather expensive considering the capabilities

7. StockHero

StockHero is a trading platform that lets you easily create bots for automated trading. You can create and backtest your bots on the platform, or subscribe to user-generated bots that are available in StockHero’s marketplace.

Key Features:

Several bot-building modules, including simple, advanced, dollar cost averaging, price, exit, sell, and grid

The bot marketplace has a wide range of intelligent bots for different market conditions.

The proprietary backtest engine offers unlimited backtesting with custom backtest periods.

Easy to use platform, with mobile apps available for both iOS and Android.

Pros:

- Multiple modules for building bots for different trading strategies

- Easy to use, especially for beginners

- Lets you backtest new bots for up to a year

- Marketplace gives you access to bots with a proven track record

Cons:

- Limited interoperability and compatibility with other brokers

- Bots might be limited to trading based on technical indicators

- Limited information about a bot’s past trades

Frequently Asked Questions about AI Trading Platforms

What are AI trading tools and platforms?

AI trading tools and platforms leverage artificial intelligence algorithms to analyze market data, identify patterns, and make trading decisions automatically or assist traders in their decision-making processes.

How do AI trading tools work?

AI tools for traders essentially leverage machine learning and statistical modeling techniques to analyze historical market data, identify trends and patterns, and generate trading signals. These signals can be used to execute trades automatically or inform traders’ decision-making.

What types of traders can benefit from AI tools?

AI-powered investing tools can benefit a wide range of traders, including retail investors, institutional investors, algorithmic traders, and quantitative analysts. These tools offer insights, automation, and efficiency, catering to different trading styles and strategies.

Are AI trading tools suitable for beginners?

Yes, AI tools can be used by beginners, as many platforms offer user-friendly interfaces, educational resources, and simulated trading environments for practice. However, beginners should first understand the basics of trading and investment principles before integrating AI tools into their trading.

Do I need programming skills to use AI trading tools?

It depends on the specific platform and the level of customization desired. Some AI tools for traders offer visual interfaces or pre-built strategies that do not require programming skills, while others may require coding proficiency for building and customizing algorithms.

Are AI trading tools safe and reliable?

AI-powered tools can be safe and reliable when used appropriately and in combination with proper risk management strategies. However, like any trading tool, there are risks involved, including potential technical failures, data inaccuracies, and market volatility. Investors should do thorough due diligence and use caution when using AI tools for trading.

Can AI trading tools predict market movements accurately?

While AI trading tools can analyze historical data and identify patterns, predicting future market movements with 100% accuracy is inherently challenging due to the complexity and unpredictability of financial markets. AI tools can provide insights and probabilities based on historical data, but there are no guarantees of future performance.

What are the costs associated with AI-Powered trading tools?

The costs of these tools vary depending on the platform, features, and services offered. Some platforms may offer free or low-cost access to basic functionalities, while others may charge subscription fees or require payment for advanced features and data access. Users should consider their budget and requirements when evaluating the cost-effectiveness of AI tools for trading.